DI’s Works Vol.8

An interview with DI’s Executive Officers Masami Hamada × Katsuhiko Handa

DI's Business Investment Support: From Strategy Formulation to M&A and Beyond Value Enhancement

Dream Incubator Inc. (DI) is a business production company that offers consulting services for major corporations on a wide range of growth strategies and supports the establishment of new businesses. Drawing on our expertise in business and venture capital investments, we offer support for client business investments and provide M&A assistance as part of our services. In this context, perspectives were shared by Mr. Masami Hamada, responsible for M&A execution support, and Mr. Katsuhiko Handa, who previously oversaw incubation investments and currently provides support for business investments.

● Executive Officer Masami Hamada

Masami Hamada graduated from The University of Tokyo’s Faculty of Economics.

His experience before joining DI in 2010 included working for The Tokai Bank, Ltd. – UFJ Bank (now MUFG Bank, Ltd.), an operating company, and a securities company. At DI, he not only assists in executing M&As but also provides support to make those M&As a success. With his extensive experience in both operating and finance companies, he has a deep knowledge of the pitfalls that Japanese companies tend to fall into when engaging in M&As overseas and advises them on how to avoid those pitfalls. In actual negotiations, he proposes optimal negotiation strategies based on intelligence and experience and provides extensive support right up to execution. Where necessary, he serves as an instructor in “practical” M&A training for executives and middle management of listed companies, with a focus on case studies.

● Fellow Katsuhiko Handa

Katsuhiko Handa holds a B.S. in Science and Engineering from Chuo University and an Executive MBA from the Graduate School of Business Administration, Keio University. He joined DI in 2017 after working for Hakuhodo Inc. and Hakuhodo DY Media Partners Inc. At DI, he was in charge of incubation (investment), mainly identifying business investment targets, executing investments, and providing hands-on support to portfolio companies. He previously served as Director and COO of Boardwalk Inc. (until Mar. 2022), Representative Director of Peaks Inc. (until Dec. 2022), and Director of ADDIX Corporation (until Apr. 2023). He was also in charge of BPI (Business Produce Installation), which promotes/supports the realization of corporate business creation strategies.

The Significance of Business Investment for Exponential Growth

---- While DI is known for its role in supporting the development of "new businesses," does it also engage in M&A and business investment support?

Masami Hamada:

At DI, we have been supporting major corporations in developing growth strategies across various areas and in the establishment of new businesses. We consider M&A and business investment as integral to achieving these goals. Our strength lies in offering comprehensive support, from strategic planning to Post-Merger Integration (PMI), drawing on our experience in business and venture investments. In our own business and venture investments, we leverage our consulting skills from our original business to formulate competitive strategies and business models and implement them diligently to increase value. Leveraging this experience, we have developed a system to offer comprehensive support, encompassing the development of new business strategies, business investments including M&A, and value enhancement in PMI. We strive to provide diverse options to companies that recognize the need to create new ventures in addition to their existing businesses.

---- Last year, there was a lot of discussion about the Tokyo Stock Exchange (TSE) requesting companies with a PBR consistently below 1x to improve their financial indicators. As a consultancy firm working with large corporations, how did DI perceive this situation?

Masami Hamada:

The Price Book-value Ratio (PBR) represents "how much market capitalization is relative to net assets," or the total capital and profits accumulated over the past. A PBR of 1x means that the stock value (market capitalization) is equal to the net assets due to the accumulation of capital and profits to date. When this falls below 1x, it signifies that the market perceives the future value of the company as negative and does not anticipate the company's future growth.

On March 31, 2023, the Tokyo Stock Exchange released a document titled "Action to Implement Management that is Conscious of Cost of Capital and Stock Price," calling for a focus on future growth by setting the goal for PBR at a minimum of 1x, rather than aiming for PBR of 1x as the target. In response to this message, an increasing number of companies are aiming for a PBR of 1x by expanding shareholder returns and other measures, but there are still few companies that can look forward to a PBR of 2x or 3x.

---- What kind of hurdles are there in achieving a PBR of 2x or 3x?

Masami Hamada:

When supporting a business, DI naturally aims not only to achieve a PBR of 1x but also to pursue further improvement. While achieving a PBR of 1x may be possible through expanded shareholder returns, reaching 2x or 3x is not an easy task. It is essential to convey to the market the company's ability to sustain growth and continuously increase profits in the future.

Simply maintaining existing businesses may lead to stable short-term performance, but it does not promise new growth. In realizing new growth, we consider business investments as an effective solution. While investments inherently involve risks, deliberately taking and effectively managing these risks can facilitate new growth.

Katsuhiko Handa:

Furthermore, business investment, which involves taking risks to pursue new challenges, can lead to secondary effects, beyond just portfolio growth, such as accumulating organizational experience and fostering resilient talent capable of driving transformation. It's often heard that companies with strong existing businesses have many employees well-versed in optimizing those operations but lacking individuals willing to take on new challenges. When such companies firmly commit to business investment, M&A, and the subsequent PMI, their internal talent undergoes a great deal of challenging experiences, allowing them to grow and transform into a company poised for even further growth.

DI's Approach to Business Investment: Strategy Formulation and Hands-On Collaboration

---- What do you consider to be the distinctive features of investments at DI?

Katsuhiko Handa:

DI's business investment begins with a comprehensive concept to change society or transform industries or sectors, developed through our business production support. It is characterized by actively engaging with the employees of the invested company in driving changes in management and business models. In many cases, we utilize the concept of "business model = hook and revenue engine" to enact transformation. The 'hook' represents differentiation and plays a role reminiscent of bait to attract customers, while the 'revenue engine' represents the profit mechanism. For example, when we made a business investment in Boardwalk Co., Ltd., we used live electronic tickets as a 'hook' and leveraged the fan data obtained to enhance profitability through revenue engines such as the sale of live goods through e-commerce and support for fan club operations.

Katsuhiko Handa:

However, it's not merely about developing an attractive strategy. Following DI's capital investment, we conducted one-on-one interviews with all employees of the investee company, repeatedly detailed our vision, and actively engaged our DI team members in the field to fortify the management foundation and drive business model transformation. Our focus on business investment, involving personal risk-taking, has provided invaluable experience, distinct from traditional consulting, and has involved sleepless nights and numerous challenges. Looking back, these experiences have proven to be tremendously valuable. The practical knowledge gained from these efforts is now instrumental in supporting our clients' business investments.

---- In particular, we think Ipet Insurance Co., Ltd.'s IPO is one of the most famous ones. Could you please tell us about this IPO’s distinctive features?

Katsuhiko Handa:

As you rightly pointed out, one of our most successful business investments was in Ipet Insurance Co., Ltd., which we began investing in in 2011. We achieved remarkable growth, increasing our sales by eleven times and our insurance contracts by nine times in approximately ten years, ultimately leading to a successful IPO in 2018. There are numerous contributing factors to this success, but I believe it was the collective effort of Ipet and DI members to address all challenges head-on. For instance, we developed a growth strategy and seamlessly executed it by advancing digital channel development, setting up contact centers, and establishing a comprehensive digital marketing framework. Additionally, our success can be attributed to our capital strategy, IPO preparations, and close collaboration with the Financial Services Agency, among other forms of 360-degree comprehensive support DI provided.

I have been emphasizing the "hands-on" approach, and it is integral to DI's support for its business investments. As mentioned earlier, when companies strengthen their existing businesses, their employees often become highly specialized and optimized for those existing operations. However, new ventures, like business investments, require individuals with diverse skill sets. Therefore, it is crucial for DI to provide these unique individuals to our business investment partners. DI itself consists of individuals with diverse and exceptional skills and personalities, leading to dynamic interactions and significant synergy.

End-to-End Support for M&As that Takes a Customer-Centric Approach

---- Given DI’s background in business investment, it has been stated that you are capable of providing comprehensive support for M&A. Can you elaborate on the specific nature of this support?

Masami Hamada:

As part of DI's core business, if the strategic planning for new business operations leads to the conclusion that M&A (business investment) is an effective solution, we leverage the insights of financial advisors to support the entire execution phase of M&A, from the exploration and approach of target companies to actual negotiations. Furthermore, drawing upon our own experience in business and venture investments, we can provide support for value enhancement during the post-M&A phase of PMI. The ability to offer comprehensive support from strategic planning to value enhancement during PMI is rare among companies, and we believe this is where DI's uniqueness and strength lie.

---- In addition to comprehensive support, does DI offer unique features in M&A assistance?

Katsuhiko Handa:

Our main goal is to ensure the success of M&A for our clients, and based on this objective, we provide a range of proprietary services developed internally at DI.

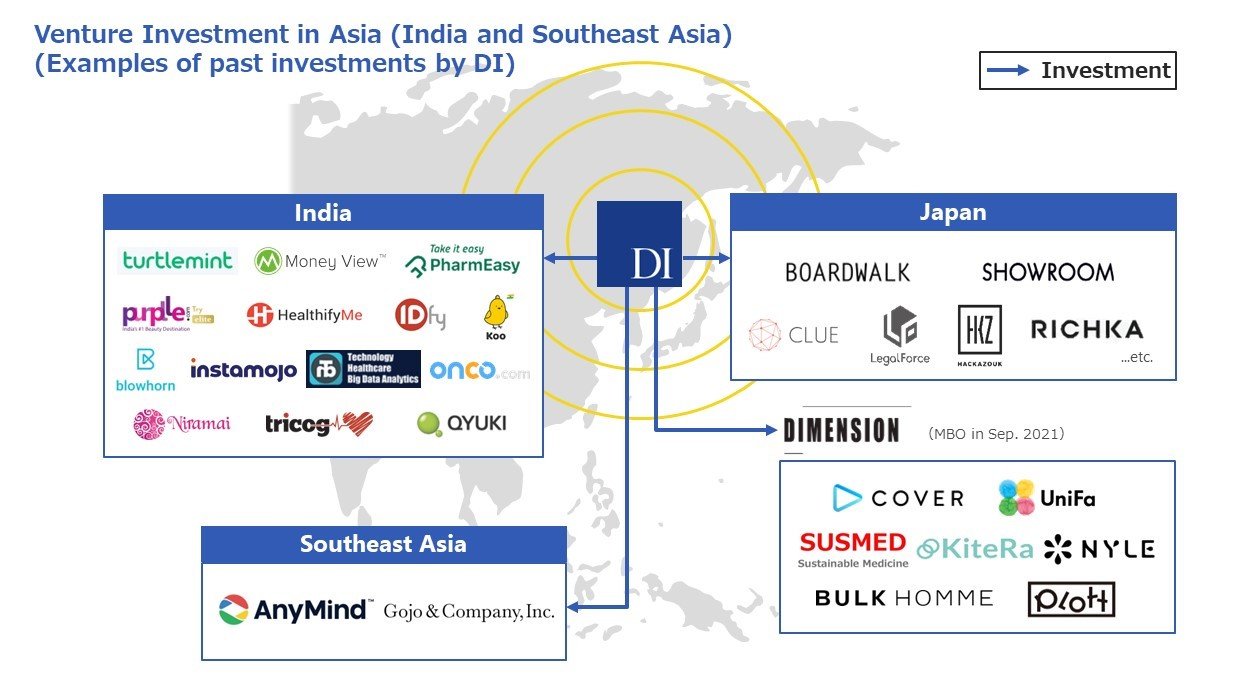

The first point is that our primary focus lies in overseas M&A, with a strong emphasis on India, Southeast Asia, and East Asia. In particular, we have actively supported numerous M&A transactions in India and have been sought out for various consultations related to market research and the identification of target companies for M&A strategic planning. Our approach aims to deliver tangible results, incorporating not only desk research but also interviews with key industry players to enhance our understanding when conducting market research and identifying potential target companies.

The second point pertains to Post-Merger Integration (PMI), in which we prioritize not only the "hard" aspects typically seen in conventional 100-day plans and KPI settings but also the "soft" aspects focused on building trust and relationships with the acquired company's management and employees, which we consider as the critical success factors for PMI. To ensure the success of "soft" PMI, we consciously address PMI not only after acquisition but also during negotiations, aiming to build relationships and trust with the acquired company's management and employees from the outset. Additionally, we provide detailed advice on the composition of personnel sent to the acquired company after the merger, ultimately enhancing the success rate of PMI. In some cases, we attend the board meetings of the acquired overseas company for a year after the acquisition, resolving mutual dissatisfaction stemming from cultural differences and similar challenges.

The third point involves support for M&A talent development, particularly related to overseas M&A. We frequently encounter situations where companies lack the personnel to send to the acquired company, even after an M&A. In response, we conduct workshops with a focus on case studies rather than lectures, as well as provide guidance tailored for personnel being sent to the acquired company.

These three distinct services have been developed as a result of leveraging lessons from our past experiences. They have emerged from our pursuit of how best to assist our clients, considering not only successes but also learning from failures, and embodying our motto of providing M&A services with a sense of ownership and commitment.

DI's Business Investments: Continuously Embracing Challenges

---- Lastly, please give a message to our readers.

Masami Hamada:

For Japanese companies, business investment has become a familiar strategic tool. However, there is still a prevailing impression that many companies have a desire to venture into M&A and business investments but are grappling with insufficient experience and resources, including talent. Within DI, we have a team with diverse expertise and capabilities, allowing us to provide support in various ways to fill the gaps our clients are facing. Moreover, we often serve as sounding boards and consultants, assisting even when clients' business investment strategies are still in the conceptual stage. In some cases, we accompany clients for nearly a year before taking specific actions. For those who aspire to achieve new growth through business investment, we are here to serve as a sounding board and a point of consultation.

Katsuhiko Handa:

While we often provide support to large corporations, we also acknowledge the presence of "challengers" within venture companies and governmental agencies. We aim to respond to the aspirations and passions of individuals in these areas. Although our conversation today has revolved around business investment, considering DI's mission of "Creating businesses that change society," our service line extends beyond business investment. If there is no existing service that fits, we will create a new one. This reflects our commitment to realizing DI's vision of being the preferred resource for "challengers."

Source (Japanese only) Link