Navigating an Alternative Venture Path in Vietnam

The emerging Vietnam VC ecosystem is maturing and seeing greater potential

A positive trend of growth is shown recently

In recent years, Vietnam’s venture capital (VC) ecosystem has observed positive growth not only in capital inflows but also in number of deals. This uptrend has made Vietnam the 3rd biggest startup ecosystem in Southeast Asia in terms of deal count. 2019 witnessed one of the most significant developments, when Vietnam shared 19 percent of total Southeast Asia’s deal counts. By the end of the following year, the country’s startup number reached 3,000 with the announcement of the 2nd startup unicorn - VNLife.

However, taken a holistic picture, Vietnam still owns a relatively young ecosystem, while later-stage deals remain limited. From 2019 to –Q1/2021, 90 percent of deals flowed into early-stage startups (Pre-Seed to Series A); in which, 50 percent of deals were made for Seed-stage. Thus, the current market still observes a conservative number of later-stage Series-B startups. Nevertheless, with proper financial and strategic support, there will be a larger number of young startups successfully moving to more mature stages. A strong example is the increase in deals above 100 million dollars. By Q1/2021, these mega-deals’ capital has accounted for 50 percent of the total capital inflow.

In terms of industry, E-commerce, B2B SaaS, and Fintech remain as the top growing sectors contributing around 45 percent of total deals. Among those, Fintech witnessed a momentous progress with the highest mega-deal numbers from leading e-wallet startups VNLife and Momo. In addition, Blockchain, Human Resources (HR), Healthcare, Logistics and Travel have been receiving rising attention from investors in the past 3 years. Especially in 2020 and 2021, the COVID-19 pandemic has been a catalyst for the adoption of HR-related technologies. As work-from-home becomes a norm during lockdown period, emerging HR startups now facilitate remote working, hence enabling normalcy even during these tough times.

Despite the pandemic, Vietnam’s startup ecosystem has been accelerating steadily since 2016 with total capital inflow growing 4 times compared to the previous period (2000-2015). More efficient structures, increasing supporting tools and high-quality founders are believed to be the core reasons attributing to this development.

Founders' quality is getting better

Since the 3rd startup wave in 2014, the ecosystem has welcomed more experienced founders with serial entrepreneurial experiences and/or an overseas education background.

“There has been an increasing number of startups being founded by 3rd or 4th generation founders with deeper experience than we previously saw when we started to deploy capital in 2016.”– Mr. Binh Tran, Partner of Ascend Vietnam Ventures

A growing trend of “Viet Kieu” (overseas Vietnamese people) returning to their motherland can be seen apparently. 90 percent of founders from TOP 10 most-funded startups in 2020 have foreign educated background and 70 percent have previous entrepreneurial experiences. Often, these founders return to start their entrepreneurship journey, as the nascent market back home seems to provide more room for innovation. A blend of both global and local mindset is a unique characteristic of this founder generation; henceforth, they tend to focus on high-tech solutions tailored to local needs and regional expansion.

In turn, Vietnamese entrepreneurs mature from experiences in competing with world-class companies. As the country allows for 100-percent foreign ownership (unlike China, Indonesia, etc.), there is increasing accessibility for top conglomerates and world-class companies coming to Vietnam. Having to compete against them from day one, Vietnamese startups could use this as an opportunity to gain more knowledge, business acumen and know-how. Hence, this generation is expected to lead the ecosystem’s growth for more unicorns.

A new wave of impact startups can be expected

Developing an ecosystem is not only about “creating unicorns”, but also about “solving social issues” via impact startups. These startups are fast-growing businesses whose main purpose is to fulfill both social solutions and financial returns. Besides financial goals, there are three key social targets for impact startups: (1) Protecting the environment, (2) Ensuring basic human needs and (3) Promoting “livable communities”.

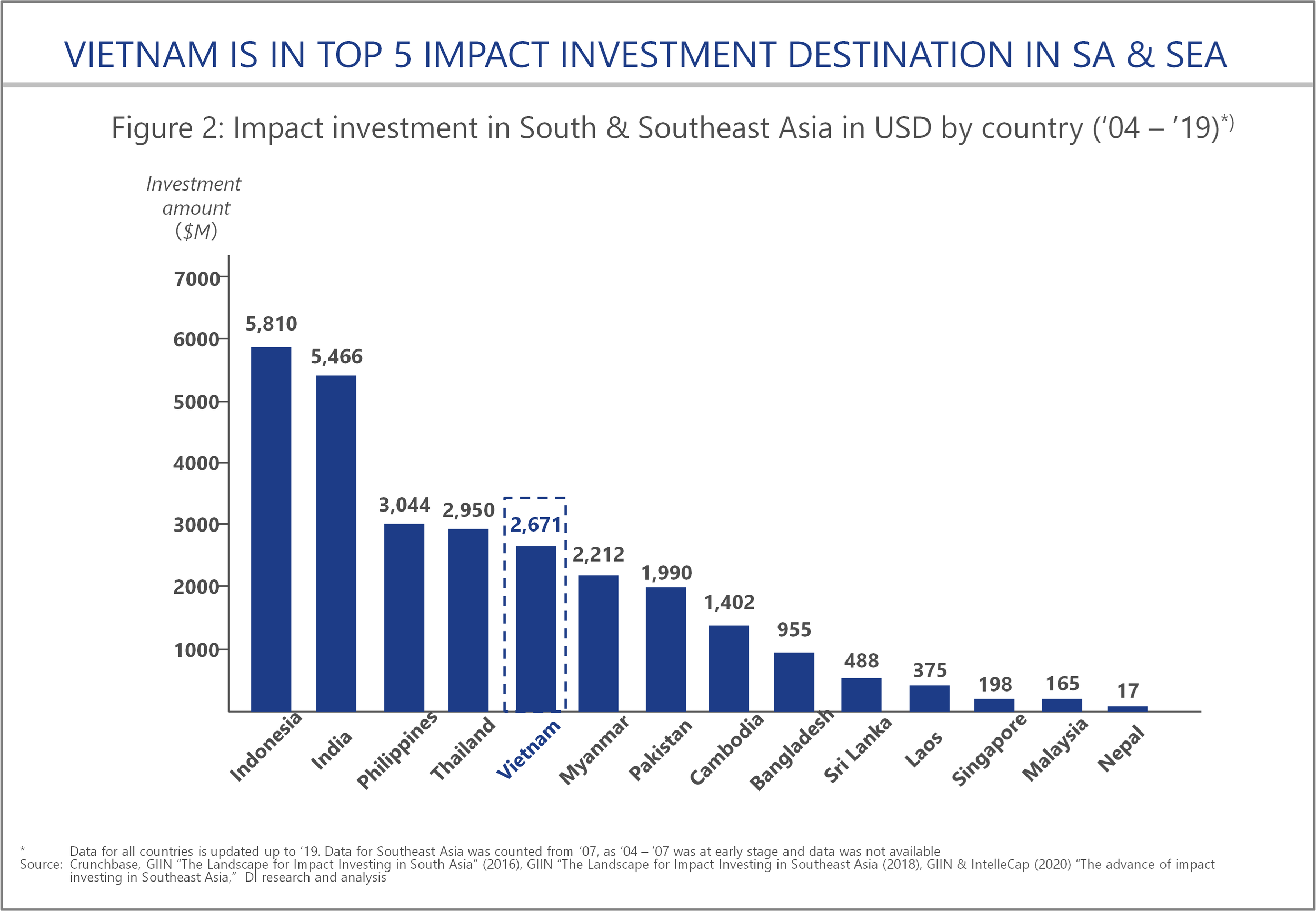

Vietnam has witnessed increasing impact investing activities in the past few years. In 2019, Vietnam was among the TOP 5 largest impact investment destinations in South Asia and Southeast Asia. Within the same year, accumulated impact capital inflow reached USD 2,671 with more than 65 percent of all deals made from 2015.

The government has also issued initiatives to support impact startups. Through Enterprise Law of 2014 and subsequent Decree 96, tax incentives will be given to registered impact startups with a stated objective to resolve social or environmental issues. At the same time, the Government has progressively brought down the corporate income tax rate from 25 percent to 20 percent over the last few years. Currently, Vietnam has around 100 registered impact startups with 80 percent located in Hanoi and Ho Chi Minh City. Around 70 percent of these target both social and financial goals. Hopefully, with continual Government support, impact startups in Vietnam will grow strongly to bring positive financial and social values to the society altogether.

However, the road to success ahead is paved with challenges

The entire ecosystem remains in its infancy

Although there has been strong growth in impact investing firms recently, the market is still very nascent and fragmented compared to India – a global top startup capital destination, and Indonesia – a fast-growing ecosystem with the most unicorns in Southeast Asia. According to a Crunchbase survey, the total amount of funding for Vietnam’s startups from 2000 is less than 1/50 of India’s and 1/5 of Indonesia’s.

“Death Valley” is still rough for Vietnamese startups

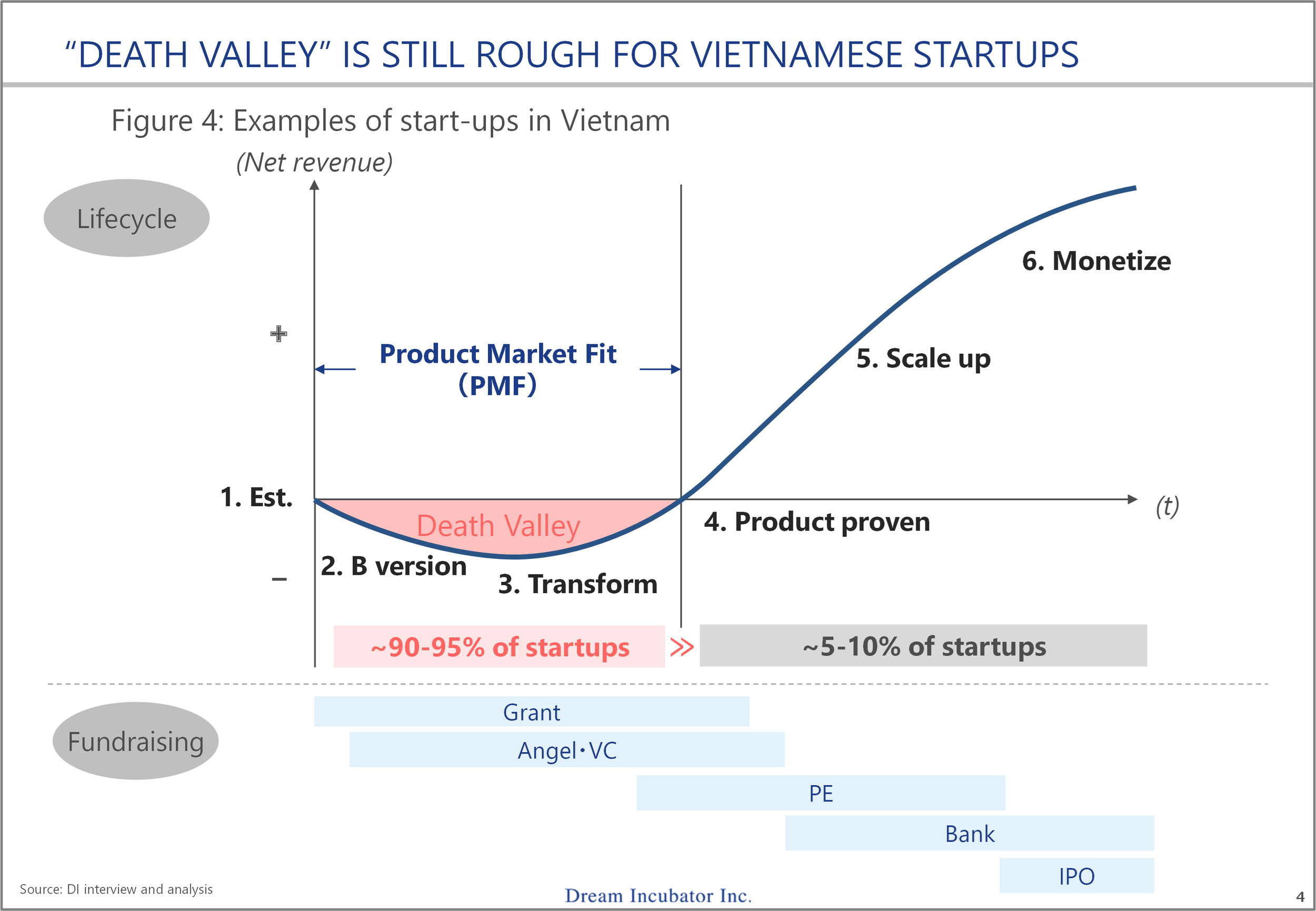

Given the present surge of global interests in Vietnamese startups, in our latest survey, there were only 10/176 deals done in Series B between 2019 – Q2/2021, meaning only around 5-10 percent of startups successfully graduated from Series A to B during this time. Meanwhile, 90-95 percent of startups fail in the early stages as they don’t have enough funding for the expansion stage.

Despite a large number of startups in Vietnam, an emerging group of global-focused investors has been seeking for years to make quality investments. This gap arises from a mismatch between investors’ certain requirements of proven successes and startups’ ability to demonstrate their potential growth. There exists a dilemma: lack in capital → unable to scale → unable to prove scalability → lack in capital. As a result, startups are limited in their access to capital and cannot secure finance from both mainstream sources and private investors. This eventually constrains the inherent potential to leverage market-based capital for social impact.

The above means even more challenges for impact startups

By nature, having to share focus partially for social purposes, impact startups are not attractive to investors due to a potentially lower rate of financial return. Most investors are demanding for market-based investments that are highly scalable and profitable.

Carrying out and fulfilling social missions may boost the cost of capital, hence, lower the internal rate of return.

Early-stage impact startups are even riskier from the investors’ perspective. While there is an excess supply of social investment funds for scaling up, seed-stage impact enterprises in the long-tail still suffer from a severe deficit of capital.

Lack of “impact” support makes many promising enterprises struggle to survive past their early stages. Challenges for most startups are the lack of not only funding but also local enablers exclusively focused on Vietnamese impact investment. Most startups rely on personal/family savings to fund their operations and growth due to limited access to collateralized loans and private equity. Also, one of the most critical constraints is inadequate access to networks, mentorship, and world-class technology for impact startups. Development of local enablers (e.g., incubators, accelerators, etc.) is essential for the supply of the above. Henceforward, growing Vietnam’s ecosystem for impact startups requires more than just capital. Impact investors should also pay attention to other assistance facilities enabling a startup’s development.

The alternative path to a bright future

There are active dynamics of impact investment in Vietnam

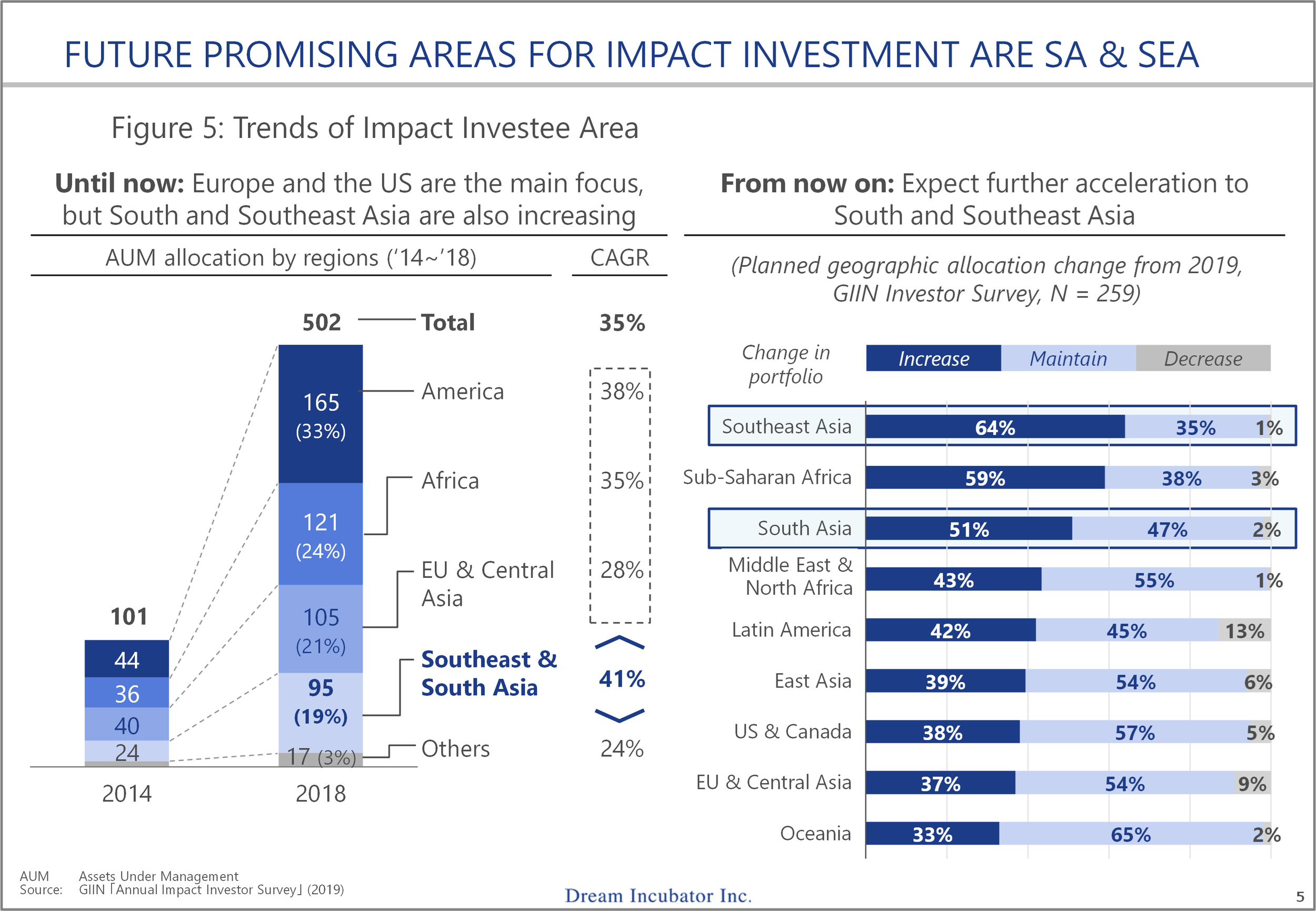

While there are several hurdles to overcome, there is a rising movement of impact investors in Asia and Southeast Asia addressing the above challenges. The quantum of impact capital deployed in the last 3 years (2017-2019) in Asia is more than half of that invested in the 10 years prior (from 2007-2016).

Particularly, impact investment amount in South and Southeast Asia increased 4 times in 4 years, with a CAGR of 41 percent. This region witnessed the highest growth compared to other parts of Asia. According to GIIN Investor Survey, Southeast Asia has seen the most prominent change in investors’ portfolio, where more than 55 percent of all deals and 58 percent of the impact capital are deployed in 3 countries: Indonesia, the Philippines, and Vietnam.

Certainly, this positive trend is beneficial to Vietnam’s impact investment ecosystem. From Series A, startups can seek funding opportunities in Southeast Asia and even globally. Many overseas funds consider Vietnam as an attractive place to invest. From venture funds’ perspectives (Ascend Vietnam Ventures), the funding demand-supply gap that existed a few years ago has been bridged thanks to the growth of regional capital inflow and the emergence of Vietnam’s corporate venture funds. Founders now can look for funding sources from both local and international investors.

From the idea stage to Series A, capital from local investors is abundant, especially in the tech sector. At the same time, regional impact investors are increasingly building presence in Vietnam. For example, Development Partners, such as the Asian Development Bank (ADB), United States Agency for International Development (USAID), Japan International Cooperation Agency (JICA), active in Vietnam for over a decade, have recently accelerated their investment efforts. Some ecosystem enablers, such as incubators and accelerators, have also offered financial support to enterprises, typically through small grants.

JICA has made a notable example of impact investment activities

Japan International Cooperation Agency (JICA) – a Japanese governmental agency delivering Official Development Assistance to developing countries, has introduced a conceptual model called Technical Assistant (TA) facilities. This supports impact startups to bridge the most critical stage of a startup company - the “Death Valley”. JICA has worked with Dream Incubator to implement a trial cycle of impact startup investment: (1) Sourcing startups, (2) Providing Product Market Fit (PMF) quasi-grant on a contract basis and/or matching with Japanese solutions, (3) Assessing social impacts, and (4) Supporting investment networks after PMF.

“The market scale of impact investment is rapidly expanding, and it will become more important for startups to be proactive in creating, measuring, and managing impact in order to raise funds and differentiate themselves from competitors. With impact investing as one of the tools, including technical assistance for PMF and impact evaluation, JICA is aiming to build an ecosystem where startups can be born and grow sustainably, becoming a driving force for economic growth and solving social issues. JICA will continue to actively collaborate with startups and ecosystem players as our partners to tackle issues together”– Mr. Tomoyuki Yamada,Director of Japan International Cooperation Agency (JICA) Economic Development Department,Private Sector Development Group

Moreover, this model is expected to be a catalyst for stronger collaboration between private sectors like VC investors and public sectors like JICA. A notable example for this TA function is the collaborating support for WeCare247, a technology platform for caregiving services to patients at home and in hospitals. Initially, to achieve PMF, the startup needed funds, mentoring and network building to scale their caregiver training program and mobile app creation.

Accordingly, the team has been assisted by both JICA and their VC investor – 500 Startups Vietnam. 500 Startups Vietnam has used their deep experiences with high-performed startups to assist their portfolio companies in building core functions with the right culture. Not only that, but they also connected the companies with relevant support networks like JICA. Being introduced by 500 Startups Vietnam, WeCare247 secured a 6-month quasi-grant on a contract basis from JICA together with mentorship, network introduction and social impact assessment. The support should be sufficient to complete the startup’s PMF plan for the next funding round. In addition to PMF assistance and networks, JICA also helps build an “engineering culture” with a more structured approach to business management. Social impact assessment is also being conducted monthly by collecting results of impact indexes to measure holistic influence on society.

With the right support and great collaboration of all ecosystem players, hopefully impact startups are well-equipped to scale and build a stronger market. However, being an impact startup is not the only way to create social impact; Venture Funds may also have interesting views on Vietnam’s startup ecosystem and the way for a startup to achieve impactful success.

Venture Fund’s view on Vietnam’s startup investment and the potential of socially impactful startups

Ascend Vietnam Ventures’ view on startup investment in Vietnam and the potential of socially impactful startups

“The startup ecosystem in Vietnam has been developing rapidly in the last few years. Back in 2017, the total amount of venture capital invested in Vietnam was only $48 million. Only 2 years later, that number has approached $1 billion. We have also witnessed the emergence of internationally successful startups from this market and invested in a number of them including ELSA (AI-driven EdTech with users in 100+ countries, later backed by Google’s AI-focused fund1), Trusting Social (financial inclusion fintech providing credit scores to ~1 billion consumers in SEA2 and India, later backed by Sequoia3), and others.

Google, Temasek, and Bain released their latest annual report on Southeast Asia’s digital economy, and it is bullish. The regional market is estimated at $174 billion in 2021 and could reach up to $1 trillion by 2030. Among the ASEAN 6 countries, Vietnam is forecasted to have the strongest growth, becoming the second-largest digital economy in the region (reaching 2/3 of Indonesia despite having 1/3 the population). This growth prospect is partially fueling increased deal activity here: the report estimates that $1.4 billion was invested in tech companies in the first half of 2021, nearly the same amount in 2019 and 2020 combined ($1.6 billion).

We believe Vietnam, with its accessibility and founder & engineering talent, is uniquely positioned to be one of Southeast Asia’s top tech hubs. There will be more global and regional market-leading startups arising from Vietnam, and these startups have great potential to positively transform the lives of people everywhere. It is worth noting that many of the problems, spending capabilities, and behaviors of consumers and small and medium-sized enterprises (SMEs) that exist in Vietnam are also likely to be found in other emerging markets across the globe. For consumers, as the low-income population transitions to lower middle-income, there are a large number of underserved needs including access to better healthcare, education, and financial products and services. In Vietnam, 98 percent of enterprises are SMEs and increasingly rely on digital solutions to acquire and serve customers, automate their work processes, manage capital, and otherwise innovate to grow in an increasingly competitive global market. These are all highly scalable and universal problems in emerging markets, and we are seeing more and more startups in Vietnam leverage data and technology to address them and in turn, generate great impact.”

An example of impactful success in Vietnam – Axie Infinity (Ascend Vietnam Ventures’ portfolio company)

“Axie Infinity, one of our prior fund’s portfolio companies, is a great example of a homegrown Vietnamese startup creating global social impact.

Launched in 2018, Axie Infinity is one of the largest NFT gaming ecosystems in the world. The game allows players to battle, collect, and trade digital pets called “Axies.” These players have complete ownership over the in-game assets and can trade in-game assets for real-world rewards, forming an economically viable digital nation. As the first game ever designed to be owned and governed by the community that plays it, it has pioneered the Play-To-Earn (P2E) business model and revolutionized how people play, live, and work within virtual worlds.

The game has amassed over 2.5 million daily active users (DAUs) worldwide and is expected to hit $1 billion in revenue within 2021. The impact generated is massive. Axie has become a gateway to financial inclusion -- 25 percent of their players are underbanked and 50 percent have not previously used cryptocurrencies. The game is a critical lifeline for lower-income people, especially those hit hard by COVID-194, creating hundreds of thousands of jobs in countries that are severely impacted by the pandemic. We are proud to be one of their earliest backers and excited to see how they will continue to transform lives around the world.”

About the Authors

The article is co-authored by a DI consultant team

Tuan-Anh (Andy) Nguyen D. D. & Kazuhiro Nakashoji are Directors, and Hieu-Linh Chu & Minh-Phuong Luu Hong are consultants at DI’s Vietnam Office.

Makoto Miyauchi is Executive Officer at DI’s Tokyo Office and the leader of DI’s Overseas Business Development Strategy.

The authors also gratefully acknowledge the support and contribution of two distinguished experts

Mr. Tomoyuki Yamada – Director of Economic Development Department, Private Sector Development Group, Japan International Cooperation Agency (JICA)

Mr. Binh Tran – Partner of Ascend Vietnam Ventures