Vietnam’s Real Estate Sector

As indicated by Savills, Vietnam residential real estate market (housing market) is one of the fastest growing in Southeast Asia. Following the 2009 financial crisis slump, the market had a quick recovery and since then has continued to grow steadily, highlighted by Vietnam’s GDP annual growth rate averaged about 12% for the period of 2000 to 2020. Despite rapid growth, the market remains nascent, fragmented, and unstandardized. Spotting opportunities within issues, a handful of PropTech (property technology) start-ups have been joining and testing out their new concepts to solve problems. In acknowledgment of the emerging landscape and remained market gaps, this article analyzes the potentials of Vietnam housing market, identifies critical pain points, and presents some notable case studies with creative solutions.

The upward trend of Real Estate Market

Housing market has been fluctuating since COVID-19 outbreak

Hardly hit by the Covid-19 pandemic in early 2020, the trading of houses is among many business activities stagnated due to public enforcement of business closure orders. However, the Vietnamese government has controlled the situation impressively well. By the end of 2021, about 90% of Vietnam population have been fully vaccinated. This somehow helped to mediate, even boost, the residential property market while the overall economy was tumbling.

Since 2022, the residential market has slowed down due to government’s decision to tighten control over real estate credit to mitigate risks of a real estate bubble. In the wake of the new policy, some banks have temporarily halted loans for real estate trading considering it is a risky area. Loans for home purchases and repairs, however, are still prioritized. It is, regardless, believed that this move is only a short-term one. The aim of it is to restrict/remove speculators, who exploit financial leverage for speculative investments for quick money, whereas people with real needs of living can have a long-term plan via mortgage down payment.

Upward trend is expected to ensue and persist due to strong macro-economic fundamentals

Vietnam’s property market is expected to see an upward trend as we recover in the new normal, driven by the rise of house demand as well as supply in the future. While urbanization trend and rising middle-class are two significant factors driving demand, there are also several government interventions boosting the supply side. As a result, this upward trend is arguably sustainable.

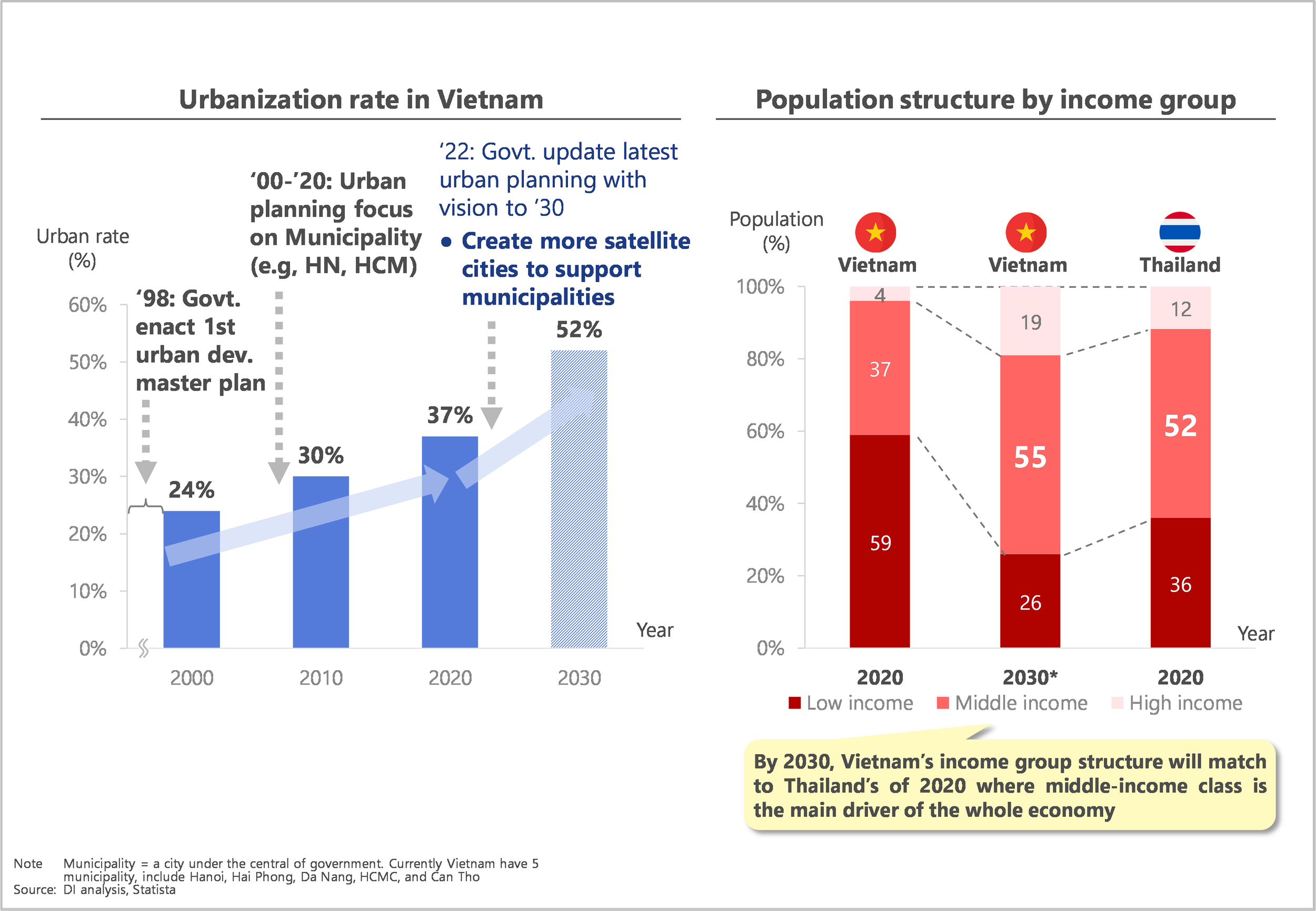

Figure 1. Urbanization rate and Population structure by Income group

① Incremental urbanization rate accelerates Vietnam’s demand for housing

To ensure sustainable development in urban planning, the Vietnamese government sets a nationwide goal of 52% urbanization rate by 2030 [1], increasing from 37% in 2020, meaning that more satellite cities will be created to support major cities such as Hanoi and Ho Chi Minh City. Long An, one out of 6 provinces that border Ho Chi Minh City, has initiated a project following the orders. A masterplan was created by People’s Committee of Long An Province, encouraging new industrial firms to enter the area to fill up more than 70% of its industrial zone. By 2021, newly established industrial parks in Long An have attracted about 150,000 workers from other places, including 2,500 expats. The migration movement, thus, triggers a rise in house demand.

② Growing middle-class buyers drive Vietnam housing market

The rise of middle-class is another significant factor driving the demand for houses, especially the middle-income housing segment such as condominiums. In fact, 80% of newly built condominiums in Vietnam in 2020 are purchased by emerging middle-class consumers [2]. According to Statista, by 2020 middle-class Vietnamese will reach 36 million, then 57 million in 2030 with a CAGR [3] of 5%, accounting for 55% of the population at that time. With the rising income, a larger proportion of the population, especially young people living independently, will find housing products such as condominiums more affordable. Young Vietnamese are getting financially independent earlier, and as the needs for housing also arise sooner, this group is driving upward the demand for home ownership. Vietnam’s neighboring country, Thailand, for instance, shared the similar trend during the period 2010-2020. The accumulated number of condominiums increased 4 times from 150,000 units in 2010 to approximately 650,000 units in 2020 [4] while the proportion of middle-income population increased from 40% to 52% during the same period. [5]

③ More land resource for housing plus lower legal barrier for new houses development

National Housing Development Strategy for the period 2021-2030 [6] regulates Provincial Authorities to prioritize land bank allocation for housing development amid any formulation/approval processes of urban planning, planning for construction of rural residential points, and industrial park planning. The target is to increase the total housing area in Vietnam by 20% in 2030. In addition, the National Assembly approved a resolution in February 2022 [7] which permits Real Estate Developers to use non-residential land that meets the conditions for changing land-use purpose to implement their housing project. Before, the type of land allowed for the implementation of such purpose was restricted to residential land.

Overall, Vietnam housing market is growing, driven by both rising demand for and supply of housing. While accelerating urbanization and growing middle-income class upleap the demand for housing, the surge in price, if not well-regulated, can generate a housing bubble. In the meantime, new decrees from the Government are boosting housing supply to meet with projected demand. The two directions of trend curb and lever up each other at the same time, thus generate a sustainable housing market growth.

Breaking down the Value Chain

Despite prospective growth, Vietnam real estate market remains non-standardized. Focusing on the secondary market, we took the most representative but end-to-end view of the housing journey.

The role of middlemen is extremely important in secondary housing transactions; however, the middle market remains fragmented

Transaction via middlemen is a common practice. In mature real estate markets such as the U.S., 87% of house transactions involve an agent or broker, with agents of developers not yet taken in account (NAR, 2021). In Germany, two thirds of houses sold are sold using brokers (The Local Germany, 2019). Vietnam as an emerging market is following the same pattern. In fact, Agents play an extremely important role in promoting transactions in the country. As per DI’s survey, 100% of respondents who used to transact in the secondary real estate market reported their working with at least an Agent throughout the process.

Despite its significance, the real estate middle market in Vietnam remains highly fragmented. Micro- to medium-sized agencies and freelance agents, being loosely regulated, currently take up more than half (Figure 2) of the brokerage market. While the 2014 Law on Real Estate Business clearly stipulates the license and tax requirements for an individual to independently provide brokerage services (Article 62), no stipulations are on service providers’ providing their brokerage business details to relevant authorities before operations. In other words, the Housing and Real Estate Market Management Agency under Ministry of Construction has not been strict enough in their management and enforcement of laws in the brokerage business field. Consequently, multitudes of entities are performing brokerage services without qualifications and standardization, competing directly against integrated, qualified ones.

Indeed, human resources in real estate brokerage are abundant in quantity but lacking in quality. According to data from the Vietnam Association of Realtors, there are 300,000 real estate brokers operating in Vietnam, but 90% operate without licenses. Inadequately trained and certified, this force of agents may be lacking in expertise, legal knowledge, professionalism, and even business ethics, posing a threat to the real estate market. For example, it is common in Vietnam to see agents performing tricks to push up land prices, partly contributing to land fever and housing bubbles.

Figure 2. Value Chain of Secondary Housing Market

Four steps are indispensable to move a deal from opening to closing

Step 1: Verification step is performed with some limitations

Agents are to visit and verify the house for sales with regards to its properties, legal status, and physical conditions. In Vietnam, all the properties and legitimacy of a house is available on the Pink Book. This document is the “Certificate of Land Use Rights and Ownership of Houses and Other Land-attached Assets” which is issued by Ministry of Construction. In common practice, Agents will ask Sellers for a notarized copy of the Pink Book and screen each section to verify the legal status of the house. Moreover, Agents/Buyers can verify the authenticity of a Pink Book (verification phase) by submitting the request to local People’s Committee Office and get the result within 5 working days.

However, when it comes to verification of physical conditions, it is troublesome for Agents to identify any defects and/or malfunctions of the houses as sellers tend to conceal them. In Vietnam, there is no legal obligations upon Sellers to truthfully declare all information about the houses either to Agents or Buyers.

Step 2: Valuation step is currently under-served

Valuation, in its simplest form, is the determination of the amount that the property will be traded on a given date. It is essential for any individuals to know the exact value of the property before making investment decisions. Moreover, it is the basis for government to determine tax bases for real estate.

According to Decree No.44/2014/ND-CP – Regulations on Land Prices, there are 5 legitimate valuation methods, namely direct comparison, subtraction, income calculation, residual estimation, and land price adjustment coefficient. In practice, the most common method used by Agents is to directly compare the target house with other houses of similar characteristics. Other methods are more applicable for professional valuation companies.

However, the direct comparison method still requires sufficient data of target house and comparables to make the comparison valid. In Vietnam, Agents – who are typically freelancers and unqualified – usually collect data via personal network (relatives, friends, and other Agents) which is limited and mostly outdated. Therefore, the current practice of valuation is far below the standard.

Step 3: Listing and matching is the most active step, particularly via Facebook and Zalo

Once verified and valuated, houses are ready to be out. With the support of Agents, Sellers can have their properties published, for example, as a listing on a listing platform or a (boosted) post on social media. Currently, Zalo and Facebook are the two most used platforms for marketing and communications. A listing platform, if used, is serving mostly the purpose of initial exploration of products and market. For the rest of the transaction process, Buyers and Sellers typically prefer direct contact with Agents. This may include in-person meetings, online chats using personal accounts, and/or on-the-spot deal processing (e.g., contract and payment).

Step 4: Legal processing involves multiple nodes and side stakeholders

The basic legal procedure entails deposit, notary of sales contract, tax payment, registrations, and ownership (Pink Book) transfer. Again, Agents may support one or more nodes of the process. In addition, this step may involve other parties, such as Public Notaries, Tax Office, People’s Committee, Ministry of Natural Resources and Environment (MONRE). However, none of these entities help to connect the other parties, thus they are not included for analysis in the chain.

Insufficient effort put in valuation step is hurting stakeholders

Along the value chain, Listing and Matching step is currently the most active, followed by Legal processing and Verification. Meanwhile, Valuation is deprioritized, hurting all stakeholders of the value chain in different ways. For example, Buyers who rely on an Agent for price negotiation will have to buy a house at an unfair price if the Agent fails to properly valuate the house. “I was shocked when being informed by neighbors that I bought the house at 5% higher than the original price that the ex- house owner (Seller) had set,” said a house Buyer in Ho Chi Minh City in an interview with DI. Accordingly, Sellers are susceptible to insufficient valuation as they cannot close deal on time due to long negotiations, which impacts their cash flow. Agents as well, either representing Buyers or Sellers, face higher risk of losing deal if they fail to reasonably convince their customers of what the fair price should be. While supposedly an essential step easing and transparentizing transaction, valuation is currently underprioritized and underperformed.

Reasons for insufficient valuation

Unavailability of sufficient housing data

Housing data contains all the data types contributed to the calculation of house price such as House properties, Legitimacy, House’s physical conditions and Transaction history. All these data types are essential variables for calculating the fair value of houses. However, only 3 out of 5 can be obtained whereas the other 2 are unavailable or inaccurate.

Table 1. List of Housing Data

From the Table 1, there is an absence of 2 critical data types used for calculating the house price, which are House Condition and Transaction Data.

Data is not available because of insufficient data disclosure

Data regarding house condition is limited since data disclosure is not strictly regulated in Vietnam. According to Point “đ”, Clause 1, Article 62 of the Construction Law, and Article 19 of Government’s Decree No. 12/2009/ND-CP, any repairing, renovating, or equipment installing activities which do not change the architecture, load-bearing structure and safety of the house need not to be disclosed by the house owner. Therefore, such changes though affecting the house’s value are never recorded. The case in Vietnam is different from that of developed markets where comprehensive data disclosure is compulsory. In California, USA, the Civil Code section 1102 mandates that Seller formally discloses, in writing, details about the property. Details include all the information about the appliances in the house, any defects/malfunctions in the house facility (walls, ceiling, doors, etc.). In most cases, Seller will delegate the disclosure to a third party such as licensed construction engineer, land surveyor to limit the liability of Seller when making required disclosures.

The transaction data, especially the house price, also encounter the issue of insufficient disclosure. It is common in Vietnam that Sellers declare with Tax Offices a lower transaction price to avoid income tax. “Usually, Sellers only declare about 30% or 50% of the real value.” [8] This practice lasts for a substantially long time, causing the lack of sufficient data for Authorities to estimate the fair market price of houses. Thus, they cannot fine those who declare the lower price due to unavailability of fair market price. This leads to an endless cycle of insufficient data disclosure. On February 2022, Ministry of Justice issued Document 489/BTP-BTTP to order Tax Department, Notary Association, and other related parties to act more aggressively in preventing tax loss in real estate. However, unless the pricing issue is solved, the Act is not sufficient.

How data problems can be tackled

Before solving the data problems, it is essential to identify (1) who holds the data, and (2) relevant models to collect data from them.

Identification of data holders

The key data holders fall into 2 groups which are (1) Stakeholders in the value chain, and (2) External data sources.

Figure 3. Identification of data holders

The 2 groups of data holders have different characteristics, and thus require separate models to approach for data acquisition.

① Model 1: Create a platform to connect fragmented Sellers/Agents and incentivize them to share data

One example is Compstak – a platform that facilitates data exchange within Agents. Compstak is founded in 2012 in New York by a well-experienced Agent. On a single digital platform, Compstak allows Agents to input transaction data of historical deals and receive data for new deals in return. By smart data validation mechanism, Compstak can ensure that Agents will receive data with the level of quality as same as the one they share with Compstak. If Agents input inaccurate or outdated data, they are supposed to get nothing in return. This eliminates the worries among Agents that they share valuable information in exchange for worthless one.

Some other start-ups collect data by incentivizing House Owners (Sellers). One example is Realm Living (Realm) – founded in late 2019 in USA. On Realm’s platform, Sellers can input all data about the houses such as land, house properties, house conditions and latest buying price. Based on such data, Realm provides Sellers with renovation plan to raise the house value. The plan includes 3 key parts: (1) which part to be renovated, (2) the total estimated cost, and (3) the estimated post-renovation price.

② Model 2: Extracting data from External Source via tech-solution

Administrative offices usually hold the most official data about housing transaction; however, data is stored fragmentedly in variable sources. Therefore, it requires much effort for players to come up with a technology to gather those data.

Citics.vn (Citics) is a Vietnam-based start-up founded in late 2019 in Ho Chi Minh City. The core service of Citics is to provide house valuation service for Banks, Large Agencies and Tax Offices. To do this, Citics collect housing data regarding Land, House Properties, Historical transactions from external sources such as Tax Offices and Public Notaries. Citics access to database of these offices via APIs; therefore, the data is updated on a real-time basis. Moreover, Citics builds a team of on-site verifiers to verify property’s physical conditions. By adding one extra step of on-site verification, the data quality is ensured, and thus the valuation is more sufficient.

Vietnam Real Estate market outlook

All in all, Vietnam housing market is growing sustainably, driven by the rise in both demand for and supply of houses. However, determining the fair price of property is a critical pain point of this market, which is primarily caused by the unavailability of adequate housing data. To tackle this bottleneck, DI suggests 2 models to gather housing data, which are (1) to connect and incentivize fragmented Sellers and/or Agents to share data, and/or (2) to extract data directly from external sources using technology. Since the market is still nascent, the potential is enormous for players with creative solutions for data issues to enter the market and offer alternative value propositions to stakeholders.

Notes

About the Authors

The article is co-authored by DI a consultant team.

Khanh-Linh Ngo, Associate